INTRODUCTION

The past couple of years have been particularly grim for the travel industry. Almost every country in

the world adopted measures, including restricted movement and border closures, in order to tackle the

global pandemic of COVID-19. The year 2022 brings renewed optimism and the industry is leaping back

towards normalcy.

The pent-up demand for travel has never been higher. These uncertain times have put life into perspective,

allowing us to double-check our priorities. This means that travelers are willing to splurge a little, and

tick off experiences and destinations from their bucket lists

1

. This substantiates the growth in the luxury

cruise segment. While we were conducting this survey, the war in Eastern Europe had just begun and its

impact on the travel industry had not yet been felt. The course of the war might affect bookings later this

year, especially considering the fact that Europe happens to be the favorite destination for luxury cruisers.

Largely, though, travel advisors report an uptick in the number of people opting to cruise in style. In this

outlook, insights have been drawn regarding the current landscape of the travel industry, specifically

around the luxury cruise segment. The expectations and hesitations of travelers, recommendations

pushed by advisors, the support they expect from cruise lines and ways to make more travelers opt for

luxury cruise lines form a part of this report.

Interestingly, one common gripe among advisors was that the call center services of cruise lines are

disorganized. Most times, these calls are handled by new staff who are not well conversant with the

product, making these calls unnecessarily long and frustrating. Others said their clients were not too

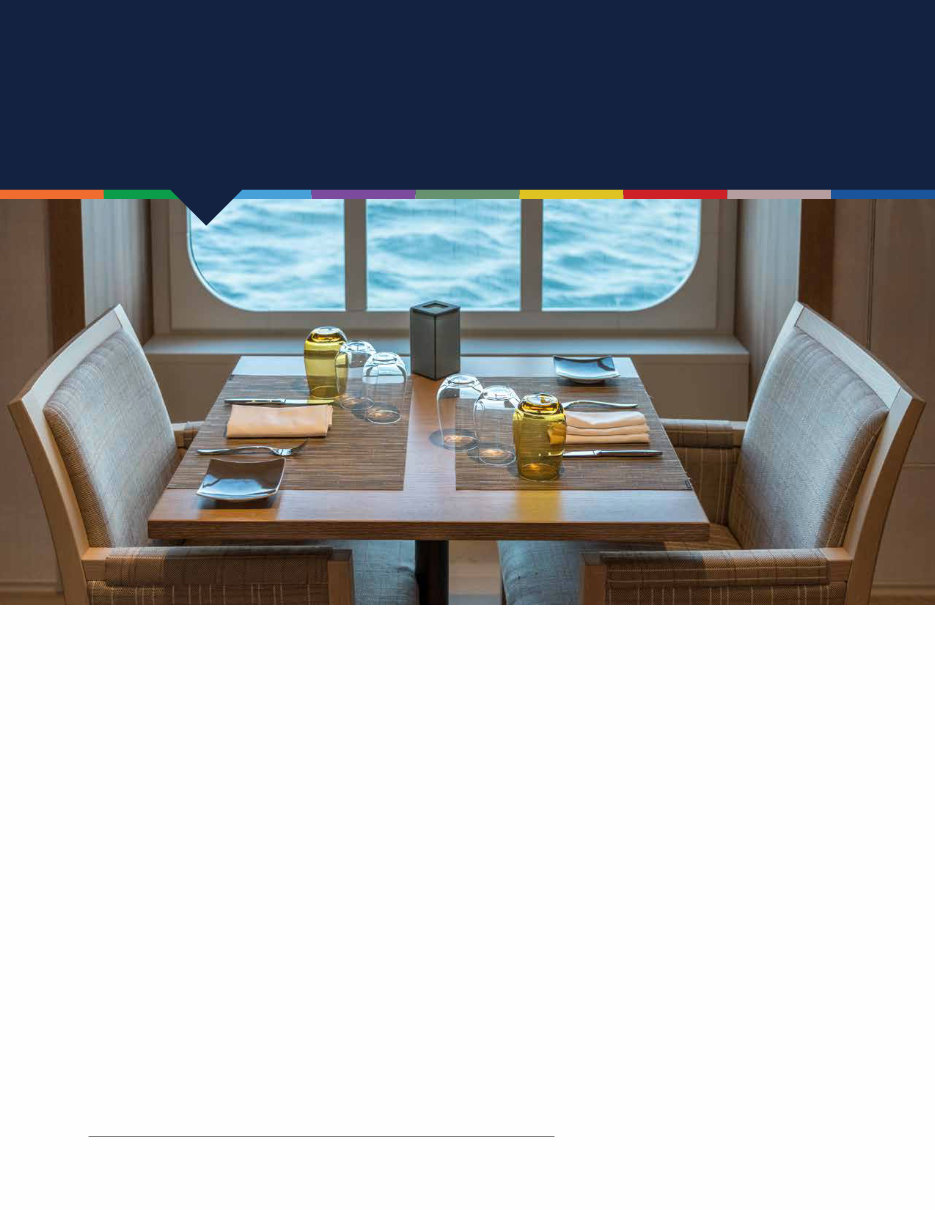

keen on taking up a luxury cruise vacation as they wanted more flexibility once they are onboard. As one

advisor commented, “My client does not want to dress up formally for each meal.”

You will find Travel Market Report’s Luxury Cruise Travel Outlook 2022 to be peppered with several such

nuances of luxury cruise travel, told from the perspective of travel advisors.

1

https://www.cnbc.com/2022/01/21/the-biggest-2022-travel-trend-go-big-spend-big-on-bucket-list-trips.html